Retail Merchant Services: The Key to Successful Payments

In today’s retail environment, it is more important than ever for businesses to offer a variety of payment options to their customers. This includes accepting credit and debit cards, as well as emerging payment technologies such as mobile payments and contactless payments.

Retail merchant services (RMS) provide businesses with the tools they need to accept a wide range of payments securely and efficiently. RMS providers offer a variety of services, including:

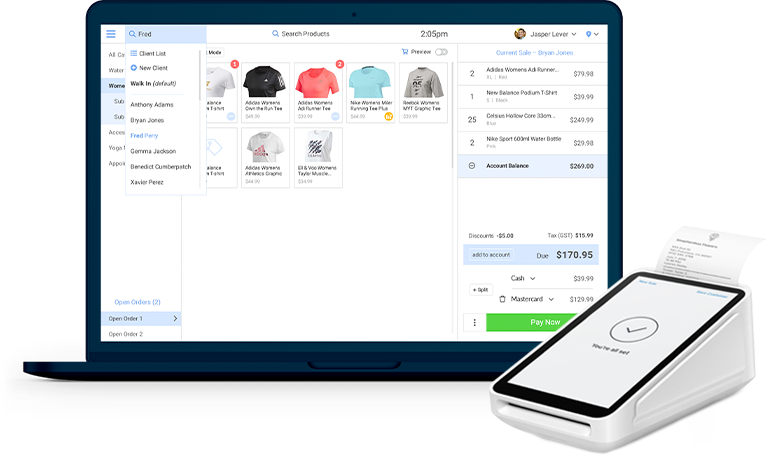

Point of Sale (POS) Systems

POS systems are the most popular type of retail payment solution. POS systems allow businesses to accept credit and debit cards at the point of sale. POS systems can be integrated with a variety of other business software, such as inventory management and accounting software. This can help businesses streamline their operations and improve their efficiency.

There are a variety of POS systems available on the market, with a wide range of features and prices. Businesses should choose a POS system that meets their specific needs and budget. Blog Top 10 Payment Trends that Irish SMEs Need to Know helps you dig into the new trends in the market.

Payment Processing for Retail:

Payment processing services allow businesses to accept credit and debit cards online and over the phone. Payment processing services typically charge a fee for each transaction processed.

Payment processing services can be a good option for businesses that do not have a lot of in-store sales. Payment processing services can also be a good option for businesses that want to accept credit and debit cards online, but do not want to purchase a POS system.

Retail Credit Card Processing

Retail credit card processing is a type of payment processing that is specifically designed for businesses that accept credit and debit cards. Retail credit card processing providers typically offer a variety of features and services, such as fraud protection and chargeback management. Card Payments: A Must-Have for Small Businesses in the 21st Century will guide you why it is important to accept credit and debit cards for payments.

Fraud protection is important for businesses that accept credit and debit cards. Fraud protection can help businesses detect and prevent fraudulent transactions. Chargeback management is also important for businesses that accept credit and debit cards. Chargeback management can help businesses dispute fraudulent transactions and recover their money.

Mobile Payment Solutions

Mobile payment solutions allow businesses to accept payments from customers using their smartphones or tablets. Mobile payment solutions are becoming increasingly popular, as they offer a convenient and secure way for customers to pay for goods and services.

There are a variety of mobile payment solutions available on the market, including Apple Pay, Google Pay, and PayPal. Businesses should choose a mobile payment solution that is accepted by their customers.There are much more choices in US market in terms of Best Merchant Services

Contactless Payment Solutions

Contactless payment solutions allow customers to pay for goods and services by simply tapping their credit or debit card on a reader. Contactless payments are quick and easy, and they are becoming increasingly popular.

Contactless payments are accepted by most major credit and debit cards. Businesses should choose a contactless payment solution that is accepted by their customers.

Retail Payment Solutions

The retail merchant services industry is constantly evolving, and one of the most significant changes in recent years has been the rise of digital payments. Consumers are increasingly using their smartphones and other devices to make purchases, and businesses need to be prepared to meet this demand.

Retail payment solutions are a range of technologies that allow businesses to accept payments from customers electronically. These solutions can be used in a variety of settings, including brick-and-mortar stores, online stores, and mobile apps.

Choosing the Right RMS Provider

There are a number of factors to consider when choosing an RMS provider, including:

- Fees: Retail merchant services providers typically charge a fee for each transaction processed. The fee structure will vary depending on the provider and the type of service you choose.

- Features and services: Make sure the provider offers the features and services you need, such as POS integration, fraud protection, and chargeback management.

- Customer support: Make sure the provider has good customer support in case you have any problems with your account.

- Reputation: Do some research to make sure the provider has a good reputation.

Retail Payment Terminal

A retail payment terminal is a device that allows businesses to accept electronic payments from customers. Retail payment terminals can be used in a variety of settings, including brick-and-mortar stores, online stores, and mobile apps.

There are a number of different types of retail payment terminals available, each with its own advantages and disadvantages.

The Future of Retail Merchant Services

The future of retail merchant services is bright. As more and more people use credit and debit cards to make purchases, Retail merchant servicesproviders will become increasingly important to retailers. Retail merchant services providers will also need to adapt to the changing landscape of payment processing, such as the rise of mobile payments and contactless payments.

Mobile payments and contactless payments are becoming increasingly popular, and they are expected to continue to grow in the future. Businesses that want to stay ahead of the curve should consider offering mobile payments and contactless payments to their customers.

In addition to mobile payments and contactless payments, there are a number of other new payment technologies that are emerging. These technologies include block chain payments, biometric payments, and voice payments. Businesses that want to stay ahead of the curve should consider adopting these new payment technologies when they become available.

By staying up-to-date on the latest payment technologies, businesses can ensure that they are offering their customers the most convenient and secure payment options available.

Here are some additional tips for choosing the right Retail merchant services provider:

- Get quotes from multiple providers before making a decision. This will help you ensure that you’re getting the best possible deal.

- Read reviews of the provider before you sign up. This will give you an idea of what other businesses have experienced.

- Ask the provider about their PCI compliance. This means that they have taken the necessary steps to protect your customer data.

- Make sure the provider offers a variety of payment options. This will allow you to accept payments from a wider range of customers.

- Make sure the provider has good customer support. This will be important in case you have any problems with your account.

By following these tips, you can choose the right RMS provider for your business and ensure that your customers have a smooth and secure payment experience.

Why choosing Business Utility Broker?

Problem

Running a successful business can be challenging, especially if you don’t have the time or expertise to manage all of your expenses. That’s where BUB comes in. We’re a business consultancy that helps businesses save money on their outgoings. Tom is the owner of The Coach Inn, a pub in the UK. He was referred to BUB by another business owner in the hospitality industry. Tom was looking for ways to save money on his energy bills, phone bills, and card payment fees.

BUB’s Solution

BUB conducted a comprehensive audit of Tom’s expenses. This included reviewing his energy contracts, phone plans, and card payment providers. BUB was able to negotiate better rates for Tom on all of these services. As a result, Tom saved a significant amount of money. BUB doesn’t just help businesses save money once. We also provide ongoing support to ensure that our clients continue to get the best deals on the market. We do this by monitoring our clients’ expenses and notifying them of any new opportunities to save money.

Conclusion

Retail merchant services are essential for businesses in today’s competitive retail environment. By choosing the right Retail merchant services provider such as Business Utility Broker businesses can ensure that they are offering their customers a convenient, secure, and efficient payment experience. By staying up-to-date on the latest payment technologies, businesses can also ensure that they are offering their customers the most innovative payment options available.