Looking For The Best Merchant Services For Small Businesses in 2023

In today’s dynamic business landscape, accepting electronic payments has become a vital component of success for small businesses in Ireland. With the continuous growth of e-commerce and the increasing popularity of contactless payments, finding the right merchant services provider has never been more crucial. In this blog, we will explore the best merchant services for small businesses in 2023, empowering entrepreneurs to embrace secure, efficient, and customer-friendly payment solutions that drive growth.

Stripe

When it comes to merchant services for small businesses, Stripe stands out as one of the most comprehensive and innovative platforms available in Ireland. Offering a seamless payment gateway, Stripe allows small businesses to accept a wide range of payment methods, including major credit cards, digital wallets, and local payment options. Its easy integration with popular e-commerce platforms and robust API makes it an excellent choice for businesses of all sizes. Stripe also provides top-notch security features, ensuring that customer data and transactions are protected. Furthermore, its competitive pricing and transparent fee structure make it an attractive option for small businesses in Ireland. Checkout the blog for more understanding card payment solution

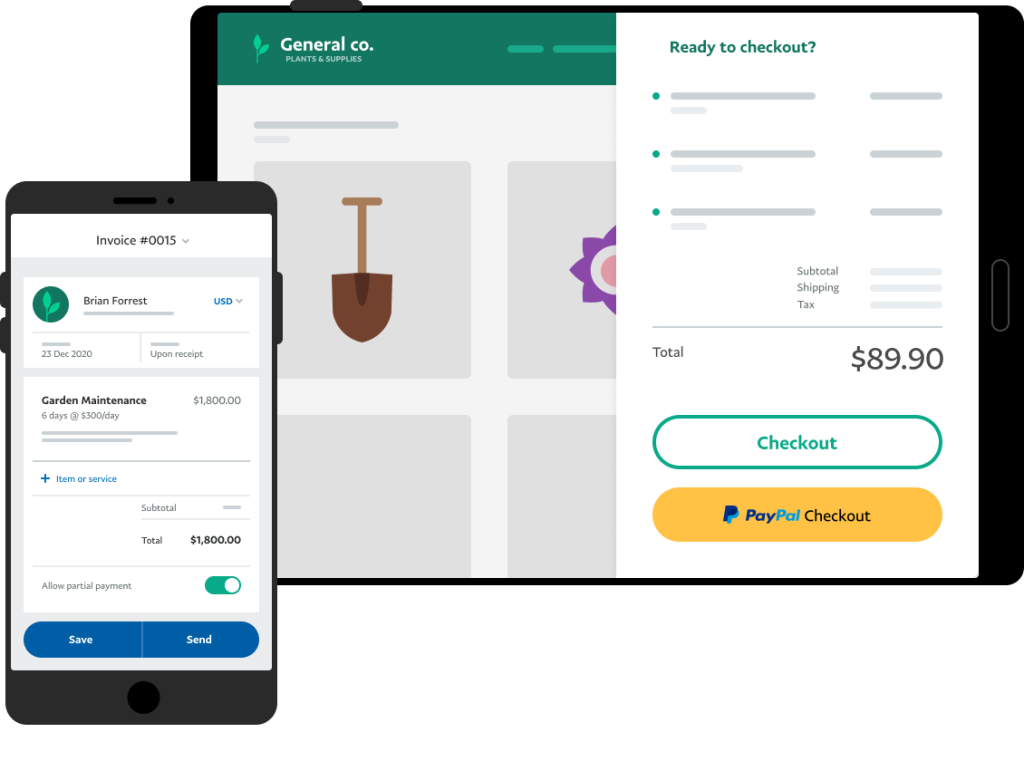

PayPal

As a globally recognized payment solution, PayPal continues to be a popular choice for merchant services for small businesses in Ireland. Offering a user-friendly interface, PayPal allows businesses to accept payments from customers worldwide. With its extensive network, customers can use their PayPal balance, bank accounts, or credit cards to complete transactions. Additionally, PayPal offers integration with various e-commerce platforms, making it easy for businesses to set up and start accepting payments quickly. Its strong security measures and buyer protection policies provide peace of mind for both businesses and customers. PayPal’s reputation and widespread adoption makes it the best merchant services for small business in 2023.

Square

Square has emerged as a leading merchant services for small businesses provider in Ireland, particularly for those operating in the retail and hospitality sectors. With its sleek point-of-sale (POS) system and card readers, Square enables businesses to accept payments in-store or on the go. The platform offers a range of additional features, such as inventory management, sales analytics, and invoicing tools, allowing small businesses to streamline their operations. Square’s intuitive interface and easy setup make it an ideal choice for entrepreneurs without extensive technical knowledge. Moreover, the transparent pricing structure, absence of long-term contracts, and low transaction fees make Square an attractive option for small businesses with limited budgets.

QuickBooks Payments

QuickBooks Payments, offered by Intuit, is a popular choice for merchant services for small businesses in Ireland that seek seamless integration with their accounting software. With QuickBooks Payments, businesses can streamline their payment processes by accepting credit and debit card payments directly within the QuickBooks platform. This integration eliminates the need for manual data entry and simplifies the reconciliation process.

BOIPA (Bank of Ireland Payment Acceptance)

BOIPA (Bank of Ireland Payment Acceptance) is a merchant services for small businesses provider that offers comprehensive payment solutions for small businesses in Ireland. As a subsidiary of Bank of Ireland, BOIPA combines the trust and stability of a major financial institution with tailored payment processing services. One of the key advantages of BOIPA is its seamless integration with Bank of Ireland business accounts. This integration allows businesses to consolidate their banking and payment processing operations, making it easier to manage finances and access transaction data. By providing a unified platform, BOIPA simplifies the reconciliation process and enhances overall efficiency for small businesses.

Barclays

Barclays is a renowned financial institution that offers a wide range of banking services, including merchant services, to small businesses in Ireland. With its global presence and established reputation, Barclays provides comprehensive payment solutions tailored to the needs of businesses of all sizes.

Barclays offers merchant services that enable businesses to accept payments securely and efficiently. Whether it’s in-store, online, or mobile payments, Barclays provides businesses with the tools and technology to meet the evolving preferences of their customers. The platform supports various payment methods, including credit cards, debit cards, and contactless payments, allowing businesses to cater to a wide range of customers. Best card machine blog helps you find out better merchant services in Ireland.

Worldpay

Worldpay, a global leader in payment processing, offers a wide range of merchant services to small businesses in Ireland. With its extensive network, advanced technology, and robust security measures, Worldpay provides businesses with the tools they need to accept payments efficiently and securely.

One of the key advantages of Worldpay is its global reach. Being one of the largest payment processors worldwide, Worldpay enables businesses to accept payments from customers around the globe. This is particularly beneficial for Irish businesses that have international customers or aspire to expand their operations beyond national borders. Worldpay supports multiple currencies and payment methods, allowing businesses to provide a seamless payment experience to customers worldwide.

Conclusion:

When It comes to the best merchant services in 2023, small businesses in Ireland have a wide array of merchant services providers to choose from, each offering unique features and benefits. When selecting a merchant services provider, it is important for businesses to consider their specific requirements, industry, scalability, and budget. By choosing the right partner, small businesses in Ireland can unlock the full potential of electronic payments, drive growth, and enhance the customer experience in the ever-evolving digital landscape.

Better to approach the brokers as a one stop shop for expert advice and choice of provider that suits your needs, why not reach out to us at business utility broker or visit our blog to find more for more useful information.